Harmonic patterns have emerged as powerful tools in the world of forex trading, providing advanced strategies to traders seeking an edge in the highly volatile and competitive markets.

Understanding and effectively utilizing harmonic patterns can significantly enhance trading decisions, offering a systematic approach rooted in technical analysis.

In this blog, we will delve into the world of harmonic patterns, unraveling their intricacies and unveiling the strategies that can propel your trading success.

Harmonic patterns are based on the idea that price movements in financial markets exhibit repetitive patterns, and these patterns can be identified and leveraged to predict future price movements.

Throughout this blog, we will explore the fundamental principles of harmonic patterns, discussing their various types such as the Gartley, Butterfly, and Bat patterns.

We will uncover the tools and indicators necessary to identify these patterns accurately, as well as the key elements and ratios to consider when analyzing them.

Furthermore, we will go beyond the basics, delving into advanced techniques, backtesting, and real-time application, all designed to empower you as a forex trader.

Get ready to unlock the potential of harmonic patterns and elevate your trading game to new heights. Let's embark on this enlightening journey together!

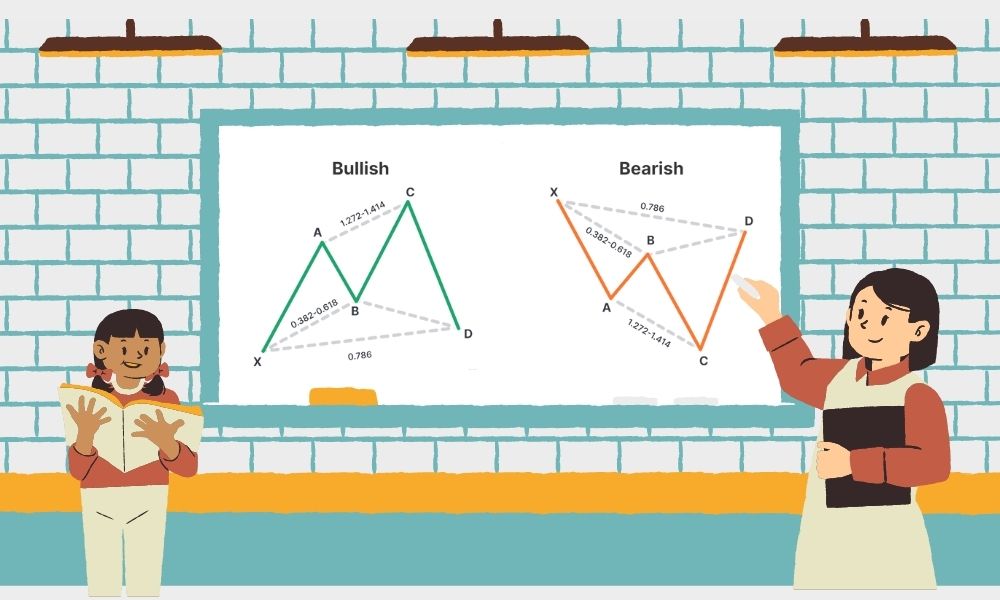

Harmonic patterns are a type of technical analysis that uses Fibonacci retracement and extension levels to identify potential reversal points in the market.

These patterns are based on the idea that market prices tend to retrace or extend Fibonacci ratios after a significant move.

There are many different types of harmonic patterns, but some of the most popular include the Gartley, Butterfly, and Bat. Each pattern has its own unique set of Fibonacci ratios that must be met in order to be considered valid.

Harmonic patterns are geometric patterns that are based on the Fibonacci sequence. The Fibonacci sequence is a series of numbers where each number is the sum of the two previous numbers.

The first few numbers in the sequence are 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, and so on.

Harmonic patterns use Fibonacci ratios to identify potential reversal points in the market. These ratios include 0.618, 0.786, 1.272, and 1.618.

When a market price retraces or extends to one of these Fibonacci ratios, it is considered to be a potential reversal point.

Some of the most popular harmonic patterns include:

Fibonacci retracement and extension levels are used to identify potential reversal points in harmonic patterns.

Fibonacci retracement levels are used to measure the amount of a price move that has been retraced.

Fibonacci extension levels are used to measure the amount of a price move that is likely to extend.

The most common Fibonacci retracement levels are 23.6%, 38.2%, 50%, 61.8%, and 78.6%.

The most common Fibonacci extension levels are 127.2%, 161.8%, and 261.8%.

When a harmonic pattern is completed, it is often followed by a move in the direction of the pattern.

For example, if a Gartley pattern is completed, it is often followed by a move up.

Once you understand the basics of harmonic patterns, you need to learn how to identify them on your own. There are a few tools and indicators that can help you with this.

One of the most popular tools for identifying harmonic patterns is the Fibonacci retracement tool.

This tool can be used to measure the amount of a price move that has been retraced.

If a price move retraces to a Fibonacci retracement level, it is more likely to be followed by a reversal.

Another useful tool for identifying harmonic patterns is the Fibonacci extension tool. This tool can be used to measure the amount of a price move that is likely to extend.

If a price move extends to a Fibonacci extension level, it is more likely to continue in the same direction.

In addition to these tools, there are a number of indicators that can be used to identify harmonic patterns. Some of the most popular indicators include:

When identifying harmonic patterns, it is important to consider the key elements of the pattern. These elements include:

The best way to learn how to identify harmonic patterns is to see them in action. There are a number of resources available that can help you with this.

Once you have learned how to identify harmonic patterns, you need to develop a trading strategy that uses these patterns.

There are a few different ways to trade harmonic patterns.

One simple way to trade harmonic patterns is to wait for the pattern to complete and then enter the market in the direction of the pattern.

For example, if a Gartley pattern completes, you could enter the market long.

Another option is to enter the market before the pattern completes. This can be done by placing a stop-loss order just below the D point of the pattern.

If the market breaks above the D point, the pattern is considered to be valid and you can take your position.

It is also a good idea to incorporate other technical indicators to confirm the validity of a harmonic pattern. Some of the most popular indicators to use include:

When trading harmonic patterns, it is important to use proper risk management techniques. This means using a stop-loss order to limit your losses and a profit target to take profits.

It is also important to trade with a small size position when you are first starting out. This will help you to minimize your losses if the trade goes against you.

In addition to the basic trading strategies mentioned in the previous section, there are a number of advanced techniques that can be used with harmonic patterns.

These techniques can help you to increase your chances of success when trading harmonic patterns.

There are a number of variations of the basic harmonic patterns. These variations can be more or less reliable than the basic patterns. Some of the most popular variations include:

Deep crab pattern: This is a variation of the Gartley pattern that is considered to be more reliable.

Three drives pattern: This is a variation of the Butterfly pattern that is considered to be more reliable.

Harmonic patterns can be traded in different time frames. Some traders prefer to trade harmonic patterns in the shorter time frames, such as the 1-hour or 4-hour time frame.

Other traders prefer to trade harmonic patterns in the longer time frames, such as the daily or weekly time frame.

The time frame that you choose to trade harmonic patterns in will depend on your trading style and risk tolerance.

One way to increase your chances of success when trading harmonic patterns is to combine multiple harmonic patterns.

This can be done by looking for patterns that are occurring in the same time frame or in different time frames.

For example, you could look for a Gartley pattern in the 1-hour time frame and a Butterfly pattern in the 4-hour time frame.

If both patterns are valid, the probability of a successful trade is increased.

| Elevate Your Trading Experience 💡 With AssetsFX 💡 |

Backtesting is the process of testing a trading strategy on historical data to see how it would have performed.

Backtesting is an important step in developing a successful trading strategy because it allows you to see how your strategy would have performed in the past.

Backtesting harmonic patterns is especially important because these patterns are based on Fibonacci ratios, which can be difficult to predict.

By backtesting harmonic patterns, you can see how they have performed in the past and make adjustments to your trading strategy accordingly.

There are a number of tools and methods that can be used to backtest harmonic pattern strategies. Some of the most popular tools include:

The method that you choose to backtest harmonic patterns will depend on your trading style and the tools that you are comfortable using.

Once you have backtested a harmonic pattern strategy, you need to validate it and fine-tune it.

Validation is the process of testing a trading strategy on live data to see how it performs.

Fine-tuning is the process of making adjustments to a trading strategy to improve its performance.

Here are some tips for validating and fine-tuning harmonic pattern trading systems:

By following these tips, you can increase your chances of success when validating and fine-tuning harmonic pattern trading systems.

Harmonic patterns can be a powerful tool for forex traders, but they can also be challenging to use effectively.

In this section, we will take a look at some real-time examples of how harmonic patterns can be used to trade the forex market.

Here are a few examples of how harmonic patterns have been used to trade the forex market in real time:

These are just a few examples of how harmonic patterns can be used to trade the forex market in real time. By studying these examples, you can learn how to identify and trade harmonic patterns effectively.

In addition to providing real-time examples, we will also analyze some successful trades that have been made using harmonic patterns.

By studying these trades, you can learn what factors contributed to their success.

For example, one of the most important factors in trading harmonic patterns is identifying the pattern early.

If you wait too long to enter a trade, you may miss out on the majority of the profits. Another important factor is setting a stop loss.

This will help to protect your profits if the trade goes against you.

No trading strategy is perfect, and harmonic patterns are no exception.

There are a few potential challenges and limitations that you should be aware of before using harmonic patterns to trade the forex market.

One challenge is that harmonic patterns can be difficult to identify. This is especially true for beginners.

Another challenge is that harmonic patterns can be invalidated by unexpected news events. Finally, harmonic patterns can be less reliable in volatile markets.

Despite these challenges, harmonic patterns can be a powerful tool for forex traders.

By understanding the potential challenges and limitations, you can use harmonic patterns to increase your chances of success.

In conclusion, harmonic patterns offer forex traders a unique and effective approach to navigate the complexities of the market.

Throughout this blog, we have explored the power of harmonic patterns, from understanding their fundamentals to implementing advanced strategies.

By incorporating these patterns into your trading arsenal and combining them with proper risk management techniques, you can significantly improve your trading outcomes.

Remember, practice and backtesting are key to mastering harmonic patterns.

Embrace this powerful tool, continue to refine your skills, and may your future trades be guided by the harmonic rhythms of success.

Happy trading!